Bi-directional charging holds a great deal of promise for electric vehicle (EV) drivers, grid operators and energy companies. Tom Hooker, Autovista24 journalist, takes a deep dive into the technology and its development.

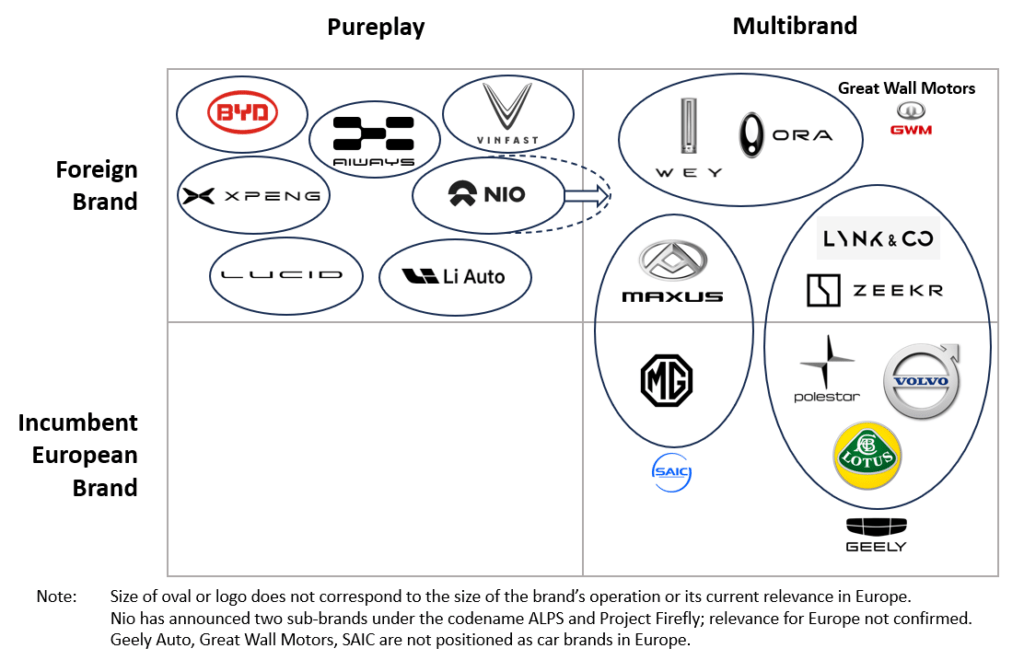

Automotive bi-directional charging is still in its infancy. Only a handful of manufacturers currently produce EVs capable of supporting the technology, with limited infrastructure also affecting adoption. Brands exploring bi-directional charging include Volkswagen (VW), BYD, Volvo, Nissan, Kia, Hyundai, MG, Mitsubishi, Polestar, Cupra, Genesis and Fisker.

To charge an EV, alternating current (AC) is taken from the grid and turned into direct current (DC) by a converter that is either in the charger or the vehicle. This is known as unidirectional charging.

Bi-directional charging takes energy from the grid in the same way but also allows energy to be sent back from the vehicle for use in a variety of applications. These range from vehicle to grid (V2G), vehicle to home (V2H), or other electrical devices or ‘loads’ (V2L).

Despite clear benefits, the reality of the technology becoming an industry standard is still a distant prospect for manufacturers, suppliers and charging companies. Building the infrastructure needed to implement bi-directional charging will be expensive, on top of ongoing developmental costs.

Charging ready

A variety of chargers already support the dual flow of electricity. However, the effectiveness of two-way charging and the amount of energy that can be put back into the grid or people’s homes depends on the advancement of EV batteries.

‘Solid-state batteries are currently in development within the industry, which is going to bring charging times down and it is also going to bring battery capacity up,’ Mark Ellis, head of commercial sales for Blink Charging in the UK and Ireland told Autovista24 at the London EV Show.

‘That is going to be interlinked in terms of how our product works itself with bi-directional charging being able to put energy back as the capacities go up. It is going to give more ability for power to be able to be deployed back to the grid via charging. I think potentially, we are looking at probably over the next 18 months where we could start to see things move quite quickly.’

One of the possible advantages of bi-directional charging is reduced energy bills or cash incentives from selling electricity back to the grid at peak times. This opens up the possibility of revenue generation. ‘People will be able to potentially charge in the evening at very low rates and then be able to go to work and sell that energy back to the grid or back to that company,’ Ellis said.

As well as providing a possible monetary boost for drivers, V2G charging could help grids remain stable, drawing electricity in periods of low demand and returning it at peak times. ‘I think vehicle-to-grid is probably the biggest one. Within the UK, there are issues in terms of how much power availability there is,’ Ellis affirmed.

‘Everyone is going to constantly look to add extra power or be able to obtain extra power, and I think this is going to become more prevalent, especially where there are businesses or areas where they have potential issues in terms of power generation or whether they can obtain demand,’ he said.

Fleet functionality

Fleets in particular could benefit from bi-directional charging, as multiple vehicles may be parked up at certain points in the day. Some infrastructure suppliers may see this as a more likely adoption point, compared to deploying the technology in charging stations or residential locations.

‘If you look at the on-the-go charging space, where typically you are looking at a few retail sites, people want to get the electricity as quickly as they can into their vehicle. So, the need for bi-directionality on the rapid or ultra-rapid chargers is probably less,’ said James Gale, head of eMobility at Gilbarco Veeder-Root Europe.

‘Where it does become interesting is fleets, because you have got vehicles that may be sitting at a location for a much more considerable amount of time and then you have got a whole battery waiting for you to utilise. Then it becomes really interesting. I think when you are talking about bi-directional, you have got to understand it will be useful in some situations but not so useful in others,’ he added.

Alec Knowles, UK industrial technical sales manager at Schaltbau, also sees the benefits of bi-directional charging for fleets. Battery power from idle EVs with V2H or V2L capability could help power workplaces and their electrical appliances, meaning grid energy is not needed during periods of high demand.

‘When you have a fleet with a company and you have got a number of vehicles in that car park, it could then be supplying energy to that factory or that premises during the daytime when charges are going to be at their peak,’ Knowles commented.

‘The problem is the car needs to be able to get the driver home at the end of the day, so if it is feeding energy into the factory during the day, it is about getting that balance right. Arguably at the factory location, it will have the most impact,’ he said.

Contactor capabilities

EVs feature high-voltage batteries, which can become dangerous in the event of a collision. In this situation, the network, and other electrical components need to be isolated from the battery cell. Contactors capable of working with bi-directional technology must make sure that this disconnect occurs.

‘Often the contactors that are in the market, that specify which direction the current has to flow, have got a positive and a negative terminal,’ Knowles said. ‘There are technical challenges to letting it go both ways. A lot of contactors only work in one direction, ours does work in both. But we have a symmetrical sort of architecture inside the contactor to do that,’ he said.

All of Schaltbau’s DC contactors have bi-directional capability, as Knowles sees the technology as pivotal to keeping the supply of electricity constant. ‘It is critical to the future because as home ownership of EVs increases, the whole supply chain or the supply of electricity to the vehicles is an issue,’ added Knowles.

‘The vehicles are batteries – in the evening you can have the car feeding electricity back into the house, or back into the grid. If there is a shortage in a particular area, then EVs in that area can provide the energy required short term. You can almost regard them as energy storage at individual homes,’ he argued.

Brand backing?

However, for bi-directional technology to become a future industry standard, both manufacturers and charging companies will need to back the feature. The Ford F150 Lighting is currently the only model in the brand’s range to offer bi-directional capabilities. The pickup truck is only available to European customers in Norway as well as a limited number of units in Switzerland.

‘I am thrilled to bits because I have been saying for years we can do this, and here it is being produced and being driven,’ said Patrick Harris, events specialist at Ford of Britain. But brands will need to convince the public, as most buyers are likely still unaware of the technology and its benefits.

‘But the question of bi-directional power, from the perspective I have on the ground here, is it gets asked for, but it is not a major thing that people are requesting, possibly because they do not know it exists,’ Harris said.

Elsewhere in Europe, VW announced that V2H bi-directional charging would be available in its ID. models. This is provided that the BEVs have a 77kWh battery capacity and the latest ID. software. Additionally, users will need a home power station integrated with a Home Energy Management System from HagerEnergy, although other stations will become available at a later date.

‘With the bi-directional charging function that is now available, we have tailored a new service offering to the needs of our customers,’ explained Imelda Labbé, VW board member for sales, marketing and after sales.

‘Not only can they save energy costs, but they are also making an important contribution to the sustainable use of energy,’ Labbé said.

Volvo is launching one of the first V2G pilot projects in Sweden. Trails are taking place in Gothenburg, where the brand is based. Last month, the carmaker announced it would launch Volvo Cars Energy Solutions, a business unit set up to explore V2H products and V2L services.

In the future, Volvo’s flagship model, the EX90, will be able to use two-way charging when equipped with the necessary software. This is alongside the EM90 which made its debut last month, the brand’s first luxury van which is exclusive to the Chinese market.

‘With the help of smart charging, you can charge your electric Volvo at the best available time from a sustainability and economy perspective,’ said Alexander Petrofski, head of Volvo Cars Energy Solutions.

‘The idea of building an energy ecosystem around your car and the batteries is that it allows you to save money and reduce your CO2 emissions, while energy firms benefit from reduced grid investments and a lower overall impact on the environment,’ Petrofski said.

Another model currently exploring bi-directional capabilities is the Hyundai Ioniq 5. The BEV took part in a V2G test in the Netherlands, with 25 units used as a solar energy storage solution capable of distributing power back to homes or the grid. In Utrecht where the project took place, over 1,000 bi-directional chargers have already been installed.

This content is brought to you by Autovista24.

Close

Close