The inaugural Autovista Group Residual Value Awards crowned value-retention champions across eight different categories. These were based on segment, body type and powertrain groupings.

Autovista Group experts analysed data from 17 different European markets. Countries included Austria, Belgium, the Czech Republic, Finland, France, Germany, Hungary, Italy, the Netherlands, Poland, Portugal, Romania, Slovakia, Spain, Sweden, Switzerland, and the UK.

Relying on Autovista Group’s vast amount of data and expertise, the 2023 awards stood out to key automotive players such as carmakers, fleet managers and leasing companies.

Small Car category

The Mini was the overall winner in the Small Car category. The iconic vehicle competed for recognition as a residual value (RV) champion in a densely-populated segment.

‘The Mini is an icon and a success story. Its strong used-car market performance is the evidence. It is proof that success can be achieved by authenticity, continuity, and a consistent brand strategy,’ said Dr Christof Engelskirchen, chief economist at Autovista Group.

The category winner was followed by the Audi Q2, Dacia Sandero, Volkswagen (VW) T-Roc and Mini’s own Countryman. The Mini was a wide-spread success, ranking in the top-five shortlisted models across Europe a total of eight times.

Small BEV category

The Jeep Avenger won in the Small Battery-Electric Vehicle (BEV) category. With a sizeable number of new all-electric models belonging to larger vehicle categories, these smaller BEVs are particularly exciting as attention turns to the mass market.

‘Given its approximate four-metre size, the Jeep Avenger is quite effective as a city car. It is small, even within the small crossover category, and yet it does not lose out when it comes to space and practicality. On top of this, the Jeep Avenger adds off-road ability and impressive handling, making it one of the most fun-to-drive small crossovers on the market,’ said José Pontes, data director at EV-volumes.com.

The Fiat 500e, the Dacia Spring-e and the Hyundai Kona all frequently appeared in the top-five lists of different countries. The 500e made the shortlist in 12 out of 17 countries, Dacia’s Spring-e is attractively priced, which helped it perform well, while the Kona was also a contender for the crown.

Compact Car category

The Compact Car Award went to the Mercedes-Benz CLA. Considering all powertrains within the C-segment and excluding SUVs, this competitive category was led by German brands.

The pan-European results saw Mercedes-Benz take the top two spots with the CLA in first and the A-Class in second. Then came the BMW 2-Series in third, followed by the VW Golf in fourth. The BMW 2-Series Active Tourer followed up in fifth.

A total of 35 models made it into the top-five rankings in at least one of the 17 countries examined by Autovista Group experts. For example, the Cupra Born competed with the Toyota Corolla and the Mercedes-Benz B-Class with the MG4. But these cars did not make it to the overall European top-five ranking.

Compact SUV category

The Mercedes-Benz GLA won in the Compact SUV category. The vehicle came out on top in the highly-competitive C-SUV segment, which has seen rapid growth in recent years.

‘The GLA from Mercedes-Benz is the standout model amongst the contenders in Europe and therefore a worthy Autovista Group Residual Value Award winner in the Compact SUV category,’ said Engelskirchen. ‘The vehicle performed well across all markets, but it features particularly strong value retention in Germany, France, and the UK.’

A total of 31 models made it into the top five ranking across all countries examined, with a mixture of high-end premium brands that market their cars at a budget price but still offer plenty to drivers. Amongst the European top five, it was the known brands that featured prominently. Mercedes Benz, Land Rover, Audi, BMW, and Dacia competed most successfully.

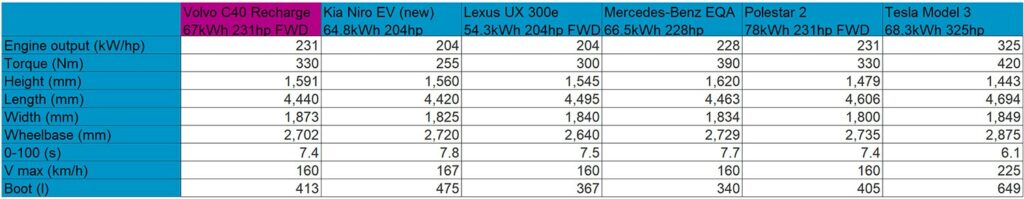

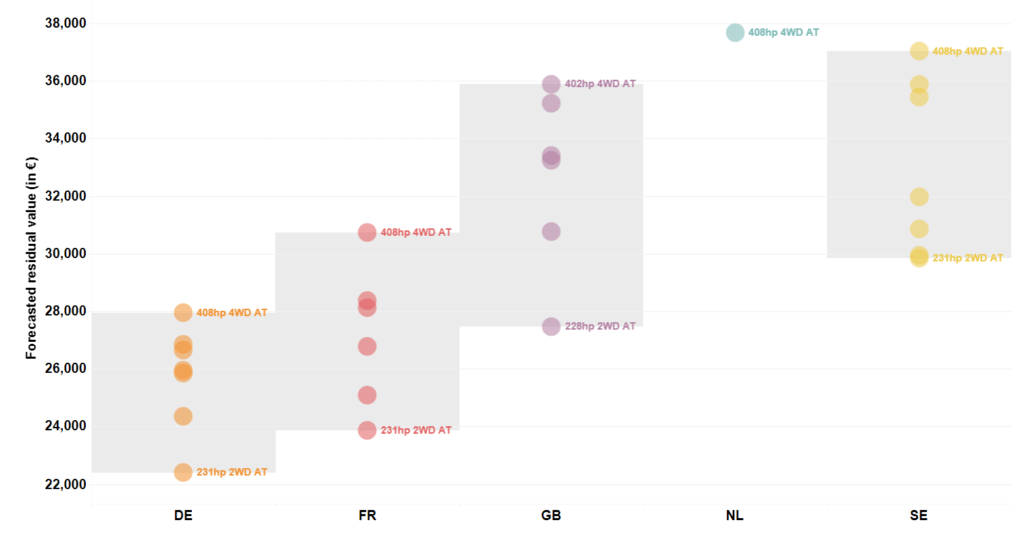

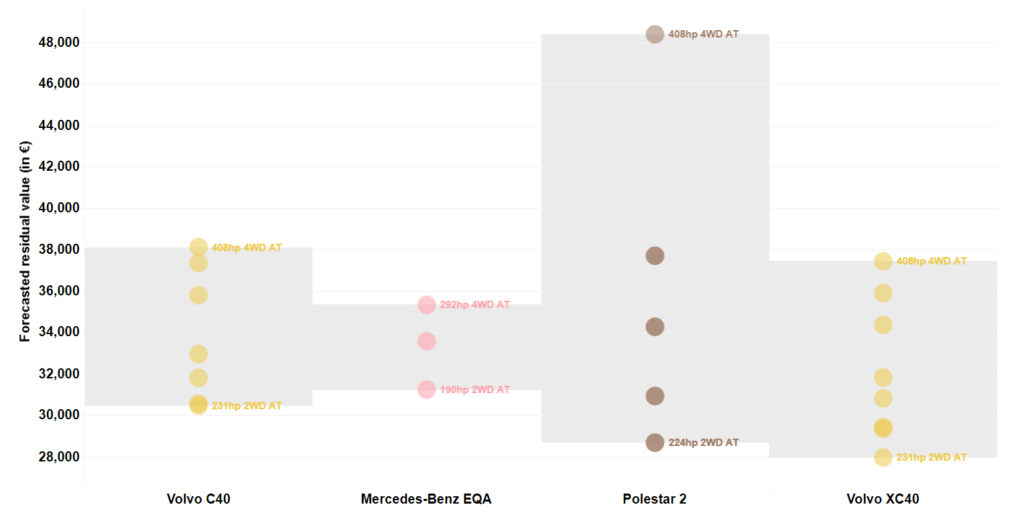

Compact and Large BEV category

The BMW i4 won in the Compact and Large BEV category. This award recognised all-electric models that often compete with SUVs in their market space.

‘The sleek electric BMW is the brand’s first step towards beating Tesla in a game that once belonged to the Bavarian make. It provides the usual BMW strong points of engaging road behaviour and presence, while adding one of the best electric ranges in its class,’ Pontes commented.

The Porsche Taycan finished in second place, performing in line with the carmaker’s strong RV performance. Third place went to the Polestar 2, a model that has proven to be a success in the segment and a popular choice amongst BEV buyers. The Tesla Model 3 came next. While still considered a crucial model in the segment, the older BEVs RVs are starting to feel the effect of list-price reductions.

Compact and Large BEV SUV category

The Tesla Model Y won in the highly contested Compact and Large BEV SUV category. The best-selling all-electric car competed against strong European rivals in the top five shortlist.

Pontes described Tesla’s BEV SUV as a default choice in its segment. ‘A bit like the VW Golf in previous decades, you cannot go wrong with the Model Y,’ he said.

Runners-up in the category included the Skoda Enyaq, which achieved a top-five positioning in nine out of 17 markets. Other notable contenders were the Audi Q4 e-Tron Sportback, the Volvo EX90, and the VW ID.4, all of which boasted a strong RV performance.

Large Car category

The Mercedes-Benz V-Class was crowned the RV champion in the Large Car category, marking the third RV Award for the German carmaker, following the success of the CLA and GLA.

‘The V-Class is the overall winner and performs particularly strongly in Germany, France, the UK and Switzerland,’ said Engelskirchen. ‘Although an electrified van, the EQV, is available, it could not steal the thunder from its diesel-powered sibling in this award category. Elegance, brand identity and versatility make strong sales arguments on both the new and used-car markets.’

The V-Class was not Mercedes-Benz’s only RV success story in the Large Car category. The luxury brand took second place with the C-Class and fifth place with the E-Class. BMW also performed well, with the 3-Series and 4-Series ranking third and fourth respectively.

Large SUV category

The Land Rover Defender won in the highly competitive Large SUV category. A star among its peers, the Defender carries over a strong brand identity from its predecessor.

Known for its iconic silhouette, the design of the new Defender makes it look less rugged while maintaining a robust and pragmatic charm. The vehicle has proven to be one of JLR’s biggest success stories, helping create significant value for the brand and those who carry the asset risks for the model.

The Large SUV award category featured models from the D and E-segments, including all powertrain types. The Defender faced fierce competition, not least from German brands. Mercedes-Benz was a top contender among the top five finalists, with the GLE Coupé, the GLE SUV, and the G-Class ranking second, third and fourth respectively. BMW’s X6 also performed solidly, landing in fifth place.

The methodology

Rather than rely on a panel of judges, the Autovista Group Residual Value Awards tapped into the vast amount of data available to Autovista Group. By collating, calculating and analysing this information, the company’s experts were able to reveal this year’s winning models. Used-car market data from February to April 2023 was utilised with forecast trade residual values of 36-month-old cars at 60,000km.

To be considered, models had to fall between the 20th and 90th percentile of the selected category’s horsepower distribution. This was to prevent the creation of a league table that featured cars with extreme power outputs, thereby distorting the results of the analysis.

Vehicles also needed to occupy the space between an entry-level price point, and those at the opposite end of the affordability spectrum, such as extreme-sports variants. This resulted in a concentration on mainstream trimlines, avoiding vehicles at either end of the price scale.

Autovista Group analysts then went on to identify the version of each model with the highest residual value, expressed as a percentage of retained list price (%RV). For each available market, models were indexed by dividing their %RV by the average %RV in that category.

The RV awards were given based on a category’s average index across selected countries. This was then weighted against each market’s new-car sale volumes, so that extraordinary results from high-volume markets were represented in the final figures.

This content is brought to you by Autovista24.

Close

Close