The global electric vehicle (EV) market broke records throughout 2023. Leading this charge was the Tesla Model Y. José Pontes, data director at EV-volumes.com, unpacks the year and its most popular performers.

New EVs, consisting of battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs), saw global registrations jump 35% year on year in 2023. This allowed the electric market to end above the 13 million mark for the first time.

Plug-in models made up a record 22% of the entire new-car market in December, with BEVs accounting for 15% alone. This pushed 2023’s total EV share to 16%, a small rise from 14% in 2022. BEVs made up 11% of registrations worldwide last year, up from 10% in the previous year. It is worth considering that the overall global new-car market experienced double-digit growth in 2023.

PHEVs (up 47%) saw registrations grow more quickly across 2023 than BEVs (up 30%). This meant the hybrid powertrain increased its share of the EV market, reaching 31%, up from 28% in 2022. The PHEV share has been fluctuating between 26% and 31% since 2018, supporting the notion that the technology could remain relevant for a while.

Best-selling car in 2023

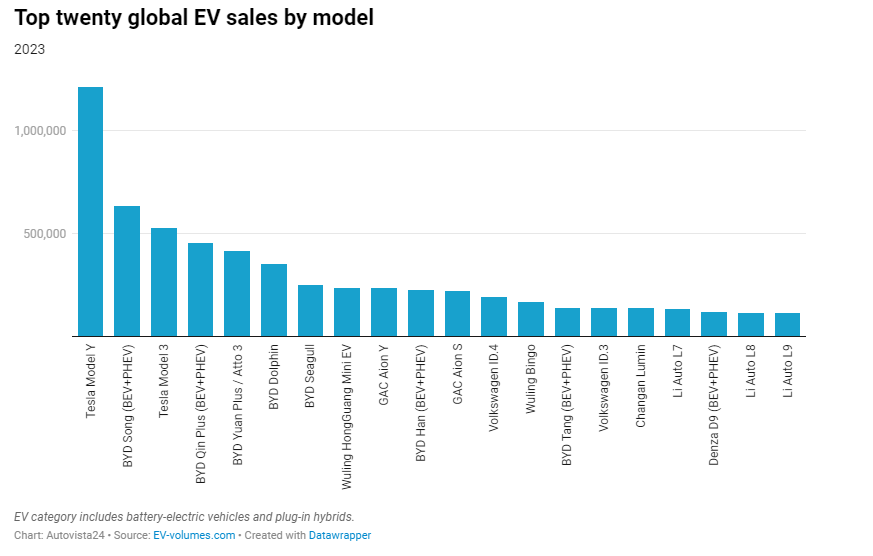

The Tesla Model Y recorded 1,211,601 registrations across 2023. This made it the best-selling model in both the new EV and the overall new-car market. The BEV saw deliveries grow 57% year on year, up from 771,000 units in 2022. The crossover can be expected to stay a market leader in 2024.

The BYD Song secured second place, as the Chinese SUV ended the year with 636,533 registrations, up 33% on 2022. Meanwhile, the Tesla Model 3 hit a new record of 529,287 registrations, putting it in third.

But despite its recent refresh, the Model 3 has reached full maturity. The sedan has seen its market share erode from 14% in 2019 to 12% in 2020, then 8% in 2021, 4.7% in 2022 and 3.9% last year. Sales have struggled to maintain momentum since hitting over 500,000 units in 2021.

Compared with 2019, last year’s result represents growth of 6% for the Model 3. But in the same period, the EV market more than doubled from 6.6 million units to nearly 13.7 million units, illustrating the BEV’s market limits.

BYD’s block

Below the top three, there was a block of BYD models. This included the Qin Plus in fourth, the Yuan Plus/Atto 3 in fifth, and the Dolphin in sixth. The BYD Seagull ended the year in seventh, profiting from a great performance in December and jumping two places. This meant the top seven places were dominated by just two carmakers.

The BYD Han won another full-size category title, followed by its sibling, the Tang. But both models saw declining sales in 2023, by 17% for the Han and 7% for the Tang. It will likely be much harder for the Chinese brand to retain the full-size category title in 2024.

In the second half of the table, the Volkswagen (VW) ID.3 was up one position to 15th. Last year was a great one for the hatchback, as its sales jumped 79% year on year to 139,268 units. Thanks primarily to its success in China, this is the first time the BEV crossed the 100,000 mark.

GAC Aion also had a good year with its Y and S BEVs, with sales almost doubling. This put the models in ninth and 11th respectively. But Li Auto made even greater strides, as the startup placed all three of its full-sized EVs in the top 20.

Four models from legacy OEMs made it to the top 20 in 2022, namely the VW ID.4, the Hyundai Ioniq 5, the Ford Mustang Mach-E, and the Kia EV6. But this count fell to just two in 2023, with the VW ID.4 in 12th and ID.3 in 15th. Considering the Audi Q4 e-Tron finished in 21st, the top three models from a legacy OEM all belonged to VW Group.

Success by segment

Chinese models took the EV A-segment by storm in 2023. Coming seventh in the overall EV ranking, the BYD Seagull took the category title from the eighth-place Wuling Mini EV. The Seagull is a top contender to repeat its success in 2024. The Changan Lumin came third in the category, far from the top two.

The B-segment also saw many Chinese models succeed. The category was led by the BYD Dolphin which came sixth overall, followed by the Wuling Bingo in 13th. The Peugeot e-208 came next but at a great distance from the top two with some 51,000 registrations. This was more than 100,000 units below the Bingo and some 300,000 units behind the Dolphin.

The C-segment was led by the BYD Yuan Plus/Atto 3. The crossover ended 2023 at 418,994 units, double its 2022 result. The GAC Aion Y came next with 235,861 deliveries, followed by the VW ID.4 with 192,686 registrations. Expect an exciting competition between the top two this year. However, the BYD Yuan Up, a smaller and cheaper sibling of the Yuan Plus, could provide a surprise.

Tesla’s D-segment

Tesla ruled over the D-segment in 2023. The Model Y was the clear leader, while the Model 3 came third. Between the two was the BYD Song. However, the Model Y already looks set to secure the category win again in 2024.

Three Chinese models commanded the E and F-segments. The BYD Han recorded 228,007 registrations, the BYD Tang 141,581 registrations, and the Li Auto L7 134,089 registrations. Should Li Auto or Aito want to compete for a top spot this year, a minimum production capacity of 150,000 units a year will be the bare minimum. Even so, the category leader will likely end up past the 300,000-unit mark.

Pickup trucks saw a second year of relevance in 2023 with around 52,000 deliveries, up 44% year on year. The Ford F-150 Lightening posted roughly 25,000 deliveries while the Rivian R1T managed some 15,000. Geely’s Radar RD6 took third with 4,736 units. In 2024, the Tesla Cybertruck is likely to disrupt this trio.

A total of 9,511 fuel-cell electric vehicles were registered in 2023, down 38% on 2022. This followed a drop from 2021, the year FCEVs reached a peak of 15,434 registrations. In 2023, the Hyundai Nexo (5,000 units) beat the Toyota Mirai (4,000 units).

Best-selling brands in 2023

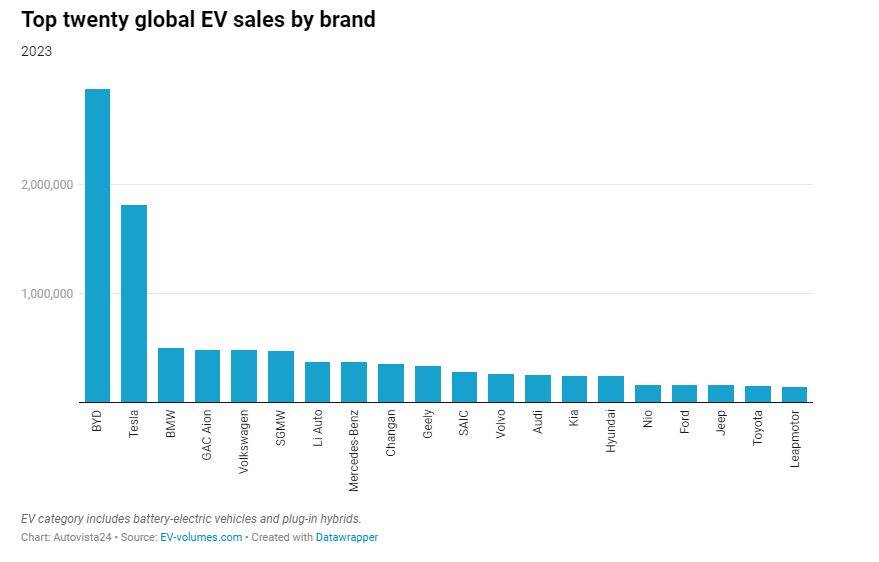

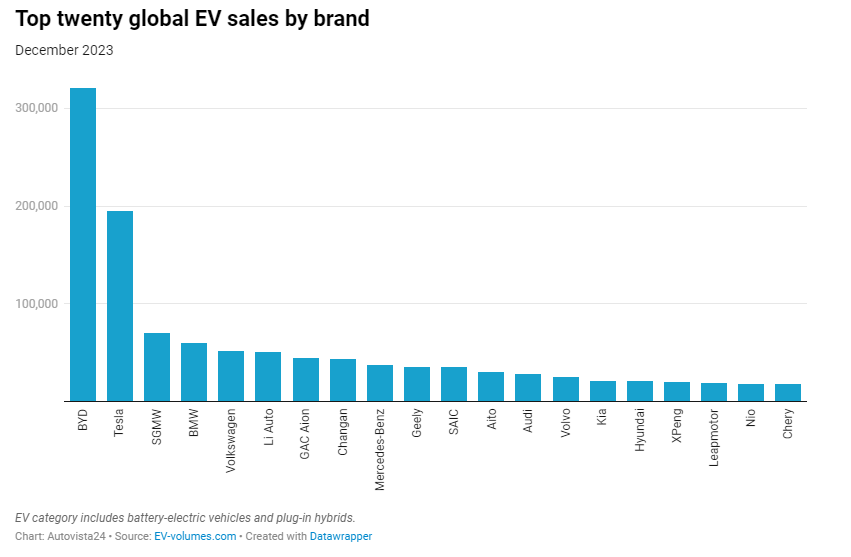

In terms of brand volumes, BYD beat Tesla by a significant margin in 2023. With a 56% year-on-year growth rate, the Chinese company was the fastest-growing marque in the top three, allowing it to increase its lead to over one million units.

However, this trend is unlikely to continue into 2024. BYD is running out of room to grow in its domestic market, meaning the demand ceiling is closing in. Yet this supports the company’s overseas strategies, plans which could come to define the EV market in 2024.

In 2023, the Chinese brand started to export its EVs in significant volumes. Israel saw 15,000 units, Brazil 18,000 units, and Thailand 30,000 units.

In second place, Tesla’s market share continued to suffer erosion. This sat at 17% in 2019, 16% in 2020, 14% in 2021, and then 13% in 2022 and 2023. This could potentially stabilise around 10% in the future. The US carmaker will need to diversify its line-up if it wants to retake the brand title.

Due to a slow first half of the year, SGMW ended in sixth allowing BMW to take third. It may be difficult for the German carmaker to hold on to this position in 2024, considering the pack of fast-growing Chinese brands behind it.

In fourth, GAC Aion grew 78% to some 484,000 units, however, this growth will be difficult to sustain. So far, the brand has not found a way to replicate the success of its S and Y models.

This puts the carmaker in the sights of the rapidly-growing Li Auto in seventh. Its three current models will reach maturity in 2024. Then there are the upcoming launches of the Mega and the L6, which could mean the brand will deliver up to 700,000 units next year.

Benefitting from a slow December for Toyota, Nio was also able to climb up the ranking in the last month of 2023. The carmaker ended the year in 16th, a five-position jump from its previous year’s standing. However, it could be difficult for the startup to remain in this spot given a lack of new models for 2024 and a sluggish export performance.

The other two brands to benefit from Toyota’s downfall were Ford, climbing one position to 17th, and Jeep, up to 18th. Out of all the legacy marques on the table, Jeep was the fastest growing, having seen its sales jump 53% compared to 2022. It ended the year as Stellantis’ best-selling brand, 23,000 units ahead of Peugeot in 22nd.

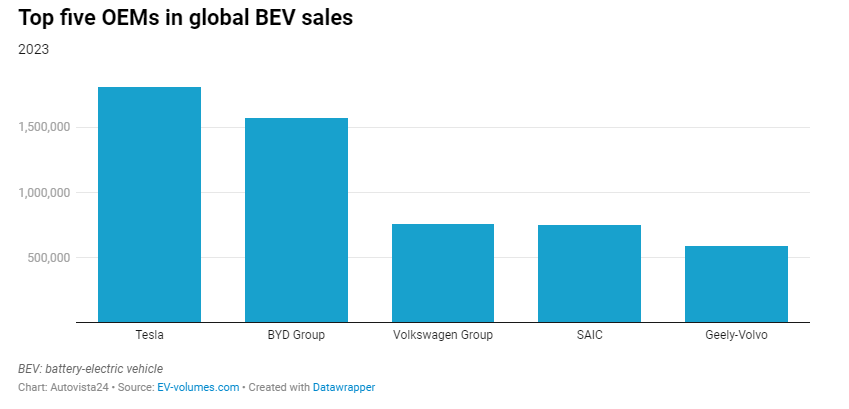

Outstanding OEMs in 2023

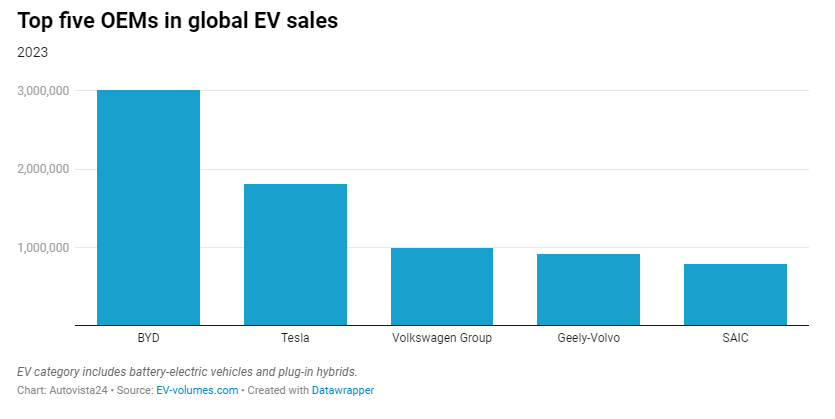

Gathering EV sales by automotive group, BYD claimed a 22% market share, with 3,012,070 registrations. Tesla came second with an 13.2% share and 1,808,652 deliveries. This puts the two OEMs in a league of their own, controlling over a third of the market together.

VW Group remained in third, with a 7.3% market share, making it the leading legacy OEM. Meanwhile, Geely–Volvo (6.8% share) took fourth from SAIC (5.8% share) towards the end of the year. This means the fight for third in 2024 will be one to watch.

Stellantis (4.2% share) stayed in sixth but has lost half a percentage point compared to the end of 2022. However, the OEM delivered nearly 600,000 units last year. This means it should reach the one-million-unit scale for EV profitability by 2025, or possibly 2026.

BMW Group (4.1%) rose to seventh place and the German OEM should be competing for sixth throughout 2024. Hyundai Motor Group (3.7% share) dropped from seventh in 2022 to ninth in 2023, losing almost a full percentage point from 4.6%. The Korean OEM was also surpassed by GAC, which ended the year with a 3.8% share.

Battle of the BEVs

Looking only at BEVs, Tesla took the 2023 OEM title with 19.1% of the global market. This was up from 18.2% in 2022 but was down from the 23% it commanded at the end of 2020. Second went to BYD with a 16.5% share of the BEV market.

While Tesla’s market is likely to erode slightly in 2024, BYD will keep gaining share. This will be thanks to a larger number of BEVs in BYD’s line-up, including the Yuan Up and Sea Lion. Additionally, exports will be more focused on BEVs, with PHEVs only being used in select markets.

VW Group took third with an 8% share, while SAIC took fourth with a 7.9% holding. In fifth, Geely–Volvo claimed 6.2% of the market. Sixth-place GAC was a sizable distance behind, with a 5.3% share. Nevertheless, the OEM had a positive 2023, up from 4% in 2022.

BYD nears local limit

There are a number of trends already emerging which provide a good insight into what the automotive market can expect from the EV segment in 2024 and beyond.

The BYD brand is already close to its demand ceiling in China, meaning the OEM is increasingly focused on its premium brands. This includes Yangwang, Fangchengbao and Denza.

With a higher average price, margins are expected to improve. This will give BYD more options when pricing its mainstream models. But with competition heating up in the Chinese EV market, BYD will need to keep its line-up fresh to hold on to its share, while also considering pricing.

As such, growth will have to come from overseas markets which is something BYD has been preparing for. As well as buying and chartering its own vehicle vessel, it is building factories in places such as Thailand, Indonesia, Brazil, and Hungary.

Tesla’s production planning

Tesla delivered 1,808,652 units in 2023, but with little in the way of new offerings, the carmaker is unlikely to see rapid growth in 2024.

Tesla’s current issue is its lack of product planning. The Model S is now 12 years old, making a second generation rather overdue. The Model X is in its ninth year, meaning a new version should have been presented by now.

Meanwhile, the Model Y (2020) has reached maturity as has the Model 3, which launched in 2017 and only saw a refresh in 2023. Their successors should, therefore, be on the drawing board. However, this does not appear to be the case. The carmaker would do well to consider how it manages the lifecycles of its products.

VW Group and Geely

While suffering some management changes in recent years, VW Group is still the best-performing legacy OEM by far. With close to one million EV deliveries in 2023, its long-term survival is well assured.

Moving into 2024, the OEM’s leading models will mature. The only new models will be the VW ID.7, the Cupra Tavascan, the Skoda Elroq, the Porsche Macan, and the Audi Q6/A6 e-Tron.

Meanwhile, Geely has been steadily gaining ground in the EV OEM ranking in the last few years, ending 2023 in fourth with 925,111 registrations. This was only some 69,000 units below VW Group.

SAIC the export expert

While SAIC excels at exporting, it could do better locally. The OEM aims to sell around 1.4 million vehicles abroad this year. However, this does include models powered by internal-combustion engines.

With 14 new EVs expected by 2026, SAIC hopes to replicate the MG4’s success with other launches. This includes venturing into the premium end of export markets with its new IM brand. Therefore, 2024 is likely to see a new MG5 station wagon, a ZS crossover, and a flagship SUV model.

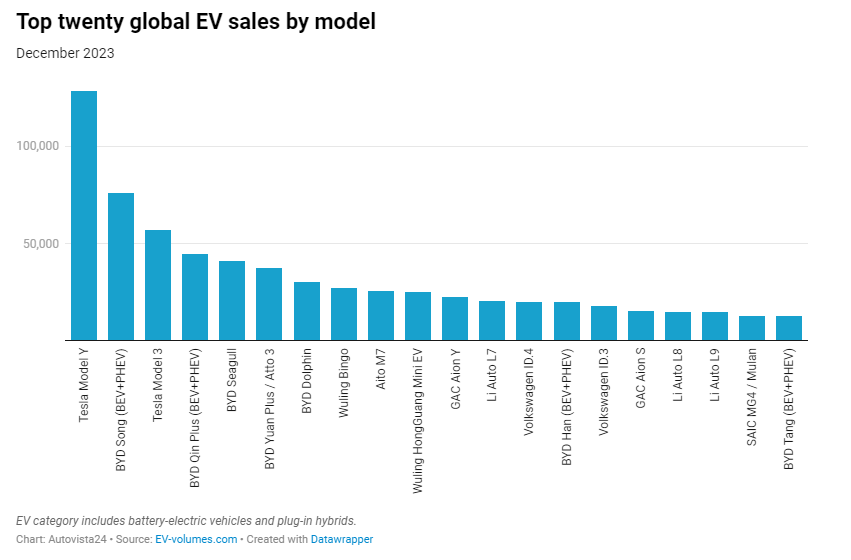

Another monthly title for Tesla

The Tesla Model Y took another best-seller position in December, with 128,410 deliveries. The crossover can be expected to keep racking up monthly titles this year as it has reached full maturity. With a refreshed version coming around April, it is likely to be the best year of the current generation.

In second place, the BYD Song hit a record 76,086 registrations. This could be its peak, with the recently-arrived Song L ready to cannibalise a significant volume of its sales in 2024, as will the upcoming Sea Lion.

Third place in December went to the Tesla Model 3, which posted more than 56,896 deliveries, ending well ahead of the BYD Qin Plus in fourth (44,701 units). Further down the ranking the Wuling Bingo came eighth (27,458 units), thanks to its continuous production ramp-up. The small EV seems ready to compete with BYD’s leading models for a top spot in 2024.

The VW ID.3 finished the month in 15th. The model recorded 17,861 registrations globally in December, its best score since the end of 2020 when VW delivered units to dealerships to comply with emission requirements.

Thanks to price cuts in China, the ID.3 saw its fortunes change completely in the market. This helped compensate for its milder performance in Europe. Elsewhere in the compact category, SAIC’s MG4 (Mulan in China) scored 12,964 registrations in December, its second record score in a row.

Made in China

Some of December’s most significant figures were recorded in the full-size category. The entire Li Auto line-up reached record heights. The L7 marked 20,428 registrations, the L8 saw 15,013 deliveries, while the L9 marked 14,913 units.

December’s best-selling full-size model was the Aito M7, which took ninth place in the EV market with 25,545 deliveries. With Huawei putting its weight behind the brand, sales increasing rapidly.

Every model in December’s top 20 was made in China. A total of 16 belonged to Chinese carmakers, with seven coming from BYD alone. This illustrates the importance of the Chinese market in the broader EV industry.

Successful SUVs

Outside of December’s top 20, the Geely Panda Mini was close to joining the table, having ended the month fewer than 300 units behind the BYD Tang in 20th. The compact Audi Q4 e-Tron was also close, with 11,260 registrations.

In the midsize category, SUVs were trending with several record-breakers. After several years on the market, the Volvo XC60 PHEV hit a best-ever global total of 7,868 registrations. Deliveries of the Lynk & Co 08 PHEV reached 10,055 units, while SAIC’s IM LS6 posted 9,878 units, and the Changan’s Deepal S7 11,360 units.

However, the recent Wuling Starlight from SGMW proved that success is not restricted to SUVs, recording 8,050 deliveries in December. In the full-size category, the Jeep Grand Cherokee PHEV reached a record 7,299 registrations.

The BMW i4 achieved another registration record, with 11,203 units delivered in December. This made it the best-selling EV produced outside of China. However, the i4 only posted a fifth of the registrations achieved by its competitor, the Tesla Model 3.

The BMW iX1 also achieved a new best of 8,775 deliveries, its third record in a row. Meanwhile, the iX also shined, with 7,027 registrations.

A record month for brands

BYD managed another record month in December, this time with 320,928 registrations. It once again beat Tesla, which posted 195,265 deliveries.

SGMW came third thanks to a best-ever monthly tally of 69,912 registrations. Its three models (the Mini EV, Bingo, and Starlight) contributed decisively to this performance. In fourth with 59,480 deliveries, BMW had a record month thanks largely to the success of its i4 fastback (11,203 registrations), but also the iX1 (8,775 units) and iX (7,027 units).

VW came fifth with 52,042 registrations, followed closely by Li Auto with a new best of 50,356 units. In the same month last year, it posted 21,233 registrations. In eighth, Changan recorded 43,095 deliveries, its second-best performance in a row, thanks to the Lumin and Deepal S7.

MG4 boosts SAIC

SAIC made it to 11th with a record 35,334 registrations. This was owing to the performance of its star player, the MG4. Aito rocketed up to 12th with its M7 SUV and even larger M9. The brand hit a record 30,108 units in December.

In 13th, Audi also registered its best month with 28,024 deliveries in December, thanks to the Q4 e-Tron. XPeng came 17th, with 7,673 registrations of its G6 midsize SUV in December. This allowed the carmaker to hit a total of 20,105 units in the month, almost catching Hyundai in 16th (20,631 units). Chery came 20th thanks to the positive results of the QQ Ice Cream (7,462 units).

Jeep landed in 21st, making it the best-selling US legacy brand as well as Stellantis’ best-selling marque. With 17,723 registrations, it achieved a new record. This was down to the continued success of the Wrangler PHEV and Grand Cherokee PHEV.

Lynk & Co came 22nd with a new best of 17,505 deliveries. The 08 SUV accounted for the bulk of the registrations (10,055 units), allowing the Chinese brand to end close to the table.

This content is brought to you by Autovista24.

Close

Close