Battery suppliers are a crucial part of the electric vehicle (EV) industry. But which company manufactured the greatest volume of EV batteries in 2023? Autovista24 editor Tom Geggus and special content editor Phil Curry explore the numbers.

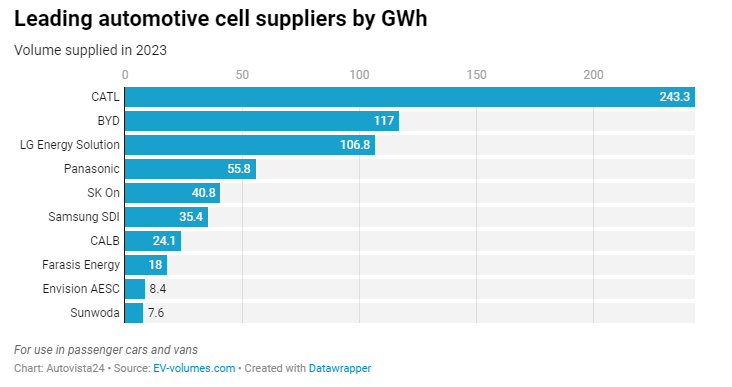

According to the latest data from EV-volumes.com, global production of EV batteries grew 42% year on year in 2023. This equated to a total output of over 680 gigawatt-hours (GWh) worth of cells made for passenger cars and vans.

Battery suppliers measure their output in GWh rather than the total number of units produced. One GWh is equivalent to one million kilowatt-hours (kWh), the measurement often found in battery-electric vehicle (BEV) specifications. If an average BEV has a capacity of 50kWh, then 1GWh worth of batteries could supply some 20,000 models.

Subscribe to the Autovista24 podcast and listen to previous episodes on Apple, Spotify, Google and Amazon Music.

Show notes

Autovista24: Who makes the most electric vehicle batteries?

Autovista24: CATL drove global EV battery production in first three quarters of 2023

CATL: CATL and JAC reach strategic cooperation to promote e-mobility

CATL: CATL and MHERO signs strategic cooperation agreement on “CATL Inside”

BYD: BYD to build a new energy passenger vehicle factory in Hungary for localised production in Europe

CATL far out in front

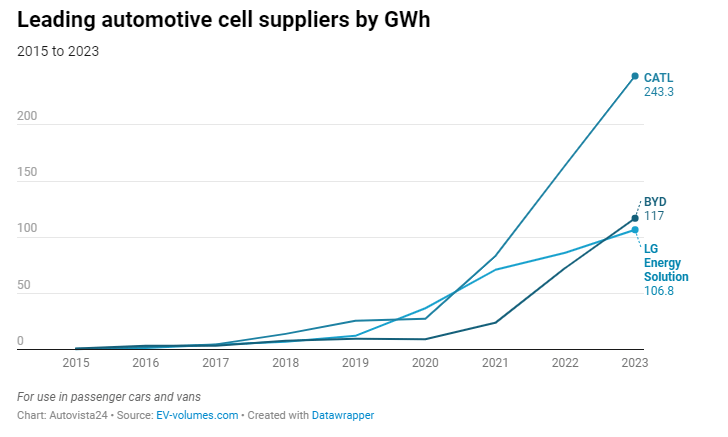

The clear front-runner in EV battery production during 2023 was CATL, with a cell output of 243.3GWh, up 48% compared with 2022. The company claimed 36% of the market across the year.

Chairman and general manager of CATL, Robin Zeng, spoke at the World Economic Forum in Davos at the beginning of 2024. He said that battery innovation is central to transitioning the world towards a clean-energy future.

Zeng outlined how scaling wider battery production will benefit the automotive industry. ‘We are focused on the aviation applications for condensed batteries, and as production scales up, we can reduce the cost and use the battery in cars, too,’ he explained.

The manufacturer also recently confirmed two new strategic collaborations. Jianghuai Automobile Group (JAC) and CATL will cooperate in the supply of EV cells, the introduction of battery-swapping technology, and the joint development of new products.

Meanwhile, the battery maker will also work with MHERO, a subsidiary of Dongfeng Motor Corporation, as part of a three-year cooperation agreement. This will see CATL function as the primary EV-battery partner for the carmaker.

European BEV production

In second place, BYD increased its battery production by 61% year on year, with a cell volume of 117GWh. This meant the manufacturer claimed 17% of the market in 2023.

At the end of the year, the company confirmed it would open a new passenger car factory in Hungary, its first facility in Europe. BYD was keen to point out its vertical supply chain integration, which it claims will help create a local green ecosystem.

While localised vehicle assembly will help keep shipping emissions down, the company has yet to confirm whether batteries will also be made locally.

In third, with a volume of 106.8GWh of cell production, was LG Energy Solution. This marked a 16% increase from its 2022 output. In total, the manufacturer claimed 16% of the EV-battery market in 2023.

The company confirmed in late January that it had invested in Sion Power, a startup holding patents in lithium-metal battery technology. A lithium-metal anode can enable greater energy efficiency compared to existing lithium-ion batteries.

A close race

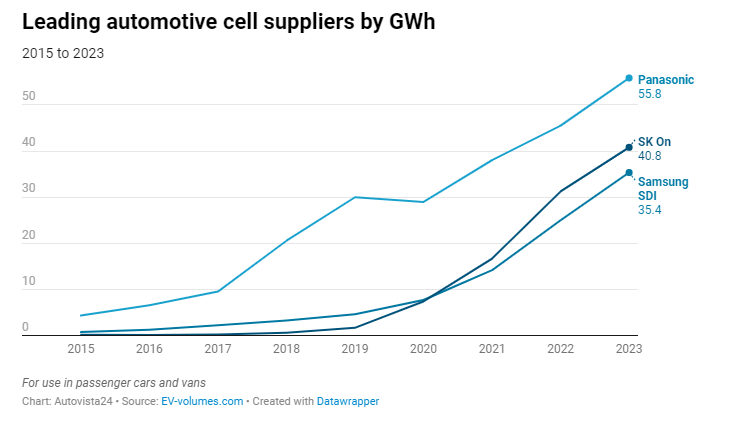

Towards the middle of the table, Panasonic claimed an 8% market share with a cell production volume of 55.8GWh. This was made for growth of 23% compared with 2022.

Next, SK On manufactured 40.8GWh worth of EV battery cells in 2023. This equated to an increase of 31% and a share of 6%. Next, Samsung SDI claimed 5% of the market, with a volume of 35.4GWh, up 41% year on year.

Huge growth

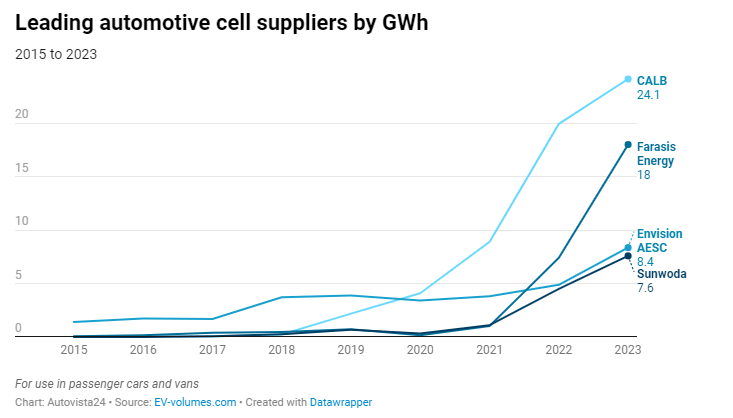

In seventh, CALB produced 24.1GWh worth of batteries, an increase of 21% on 2022. This output allowed the manufacturer to take 4% of the market. Farasis Energy achieved one of the largest rates of growth, up 143% year on year, with a volume of 18GWh and a market share of 3%.

The unspecified manufacturer category accounted for 3% of the market in 2023, equating to roughly 23.6GWh worth of cells, a total that is up by 38% year on year.

This content is brought to you by Autovista24.

Close

Close