Autovista24 principal analyst Sonja Nehls took the new Volvo C40 Recharge for a test drive and had a closer look at its remarketing potential.

Volvo introduced its first electric-only vehicle, the Volvo C40 Recharge, with a 231hp single-motor and a 408hp twin-motor all-wheel-drive variant. While the components are known from the XC40 Recharge and the Polestar 2, the C40 sports a different body style, with a sloping roofline and SUV characteristics lending a dynamic crossover look.

The Volvo C40 Recharge sports a steep list price, but with comprehensive standard equipment. It has high energy consumption but can compensate range issues with a sufficiently large battery and a 150kW DC charging capacity. It combines an emotional and sporty design with powerful motors, especially when considering the twin-motor variant. The lean interior and the comfortable ride work well in everyday driving and there is enough space for a small family.

Volvo C40 Recharge remarketing potential

| Remarketing upsides | Remarketing downsides |

|---|---|

| A simple line-up offering with comprehensively-equipped trim lines and limited options ensure transparency and well-equipped models for the used-car market. | The C40 Recharge comes at a high cost, about 7% above the Polestar 2 and only 5% below an equipment-adjusted Mercedes-Benz EQA. |

| The C40 recharge features good quality materials overall, as well as a decent fit and finish with small exceptions, e.g. use of hard plastics on the door panels. | High-energy consumption, almost 20% above the Mercedes-Benz EQA. Only one charging cable (Mode 2 or Mode 3) is standard in some markets, e.g. Germany. |

| The C40 combines the best of many worlds: * An emotional yet classic design * Enough room for a small family * A fun-to-drive and engaging BEV performance * Thanks to its clean interior and its smoothly working infotainment and assistance systems, it also does well for everyday use or in urban environments. |

The C40 is Volvo’s first electric-only model while its twin XC40 is also available as a plug-in hybrid (PHEV) or petrol version. Apart from the motor line-up, the roof is the main difference between the models, but it does make a huge difference. The coupe-like rear lends an emotional and sporty appeal. It matches nicely with the power of the 231hp single motor and the impressive 408hp and 660Nm torque of the all-wheel-drive twin-motor variant. When discussing which of the two body styles will be the more popular, Autovista colleagues from various countries agreed that the XC40’s SUV style wins the race due to its practicality advantage.

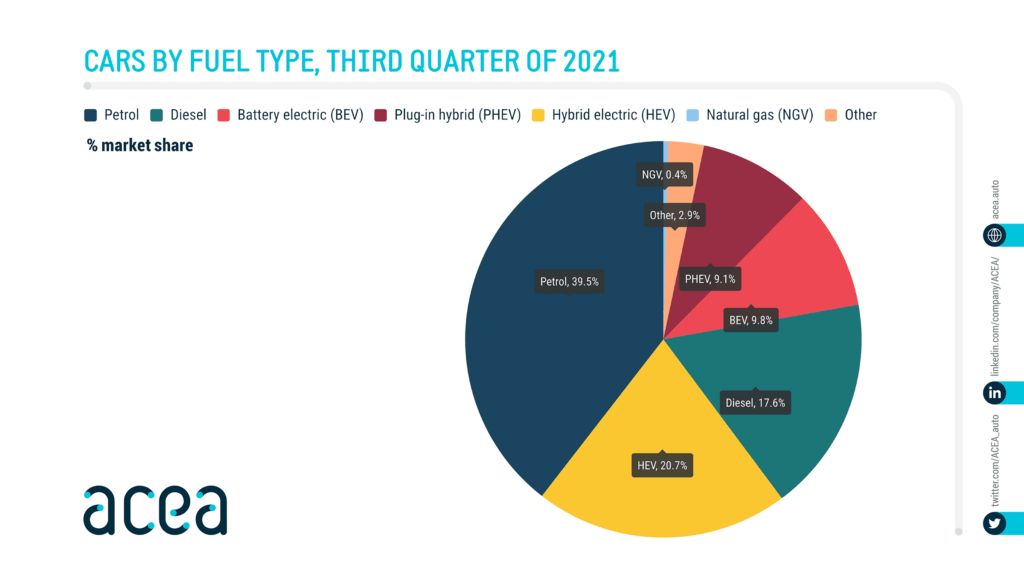

However, Johan Trus, Autovista Group’s chief editor in Sweden, added that ‘the coupe-like rear has become a common trait for many battery-electric vehicles (BEV) and customers associate it with a BEV’. The C40 might not be too far behind the XC40 when it comes to volumes. Ev-volumes.com forecasts 10,700 sold units in Europe in 2022, increasing to 17,900 in 2026. At an estimated fleet share of a least 50%, assuming an average list price of €57,000 and an average residual value (RV) of 55% this results in an annual European remarketing volume of €170-€270 million.

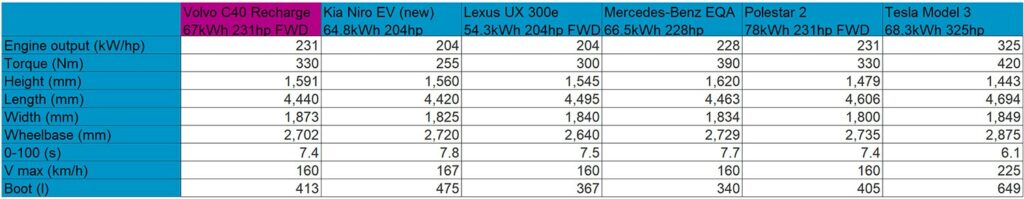

At 4.44m long, the C40 sits below other BEVs, such as the Tesla Model Y or Model 3, Volkswagen ID.5, Hyundai Ioniq5 or Kia EV6 and better compares to the Mercedes-Benz EQA, the upcoming Kia Niro or the Lexus UX e. The more sedan-like Polestar 2 shares technology with the C40, but is 17cm longer and 7cm lower.

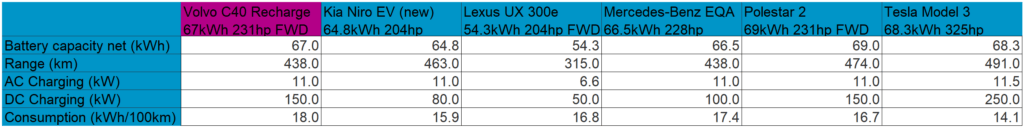

Specifications and dimensions versus main rivals

Source: Autovista Group specification data

The 67kWh battery on the single-motor C40 is among the larger ones, which partly compensates for the highest energy consumption value of 18kWh per 100km and contains a major impact on range. The C40 can also mitigate higher-energy consumption with its 150kW DC charging capacity, whereas Kia only offers 80kW and the Mercedes-Benz EQA can do 100kW. Tesla’s 250kW remains the benchmark.

BEV specifications versus main rivals

Source: EV-volumes specification data

A comparison with the sibling models demonstrates the impact of body styles. The XC40 Recharge SUV consumes 19kWh per 100km and for the lower-built Polestar 2, 16.7kWh is sufficient.

Complete standard equipment comes at a price

The Polestar 2 comparison is also interesting from a list-price perspective. While Polestar started off as the premium brand, the XC40 and now the C40 come at a comparable or even higher list price. The Polestar 2 starts at €46,495 in Germany and the long-range dual-motor version starts at €50,970. The C40 list prices range between €48,850 and €61,880.

A part of this is offset when doing an equipment-adjusted price comparison, as the Volvo benefits from an almost complete standard equipment depending on the trim, while for the Polestar you can add another two packages at €7,000. Still, a top trim C40 is 7% more expensive than the Polestar 2, including the two additional packages.

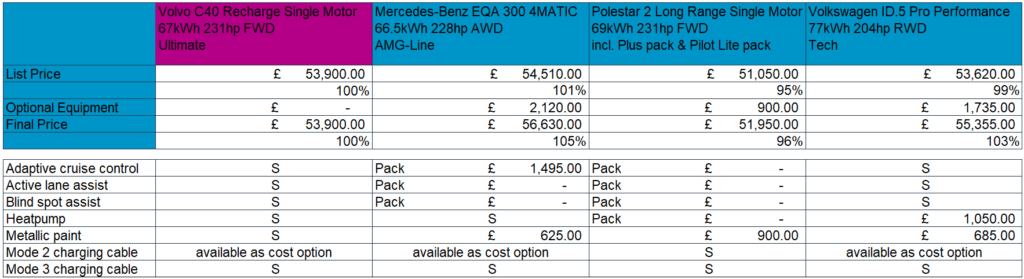

To get a better overview of how expensive the Volvo C40 Recharge is in relation to its comprehensive standard equipment and compared to its rivals, it is necessary to configure the models like for like, as far as is possible. The below example shows the situation on the UK market.

Equipment-adjusted price comparison

Note: S= standard equipment, prices given refer to cost of a pack or single option

For the sake of a reasonable comparison, the C40 was selected in Ultimate trim, which is the fully-equipped top version. The medium trim Plus does not include – or offer as an option – a rear parking camera or other crucial features from an RV-perspective and was therefore not eligible.

Comparable versions of the other models also feature comprehensive standard equipment, with the table above showing the main differences. The C40 began as the second-most expensive, 1% cheaper than the EQA and 1% more expensive than the considerably larger VW ID.5. After equipment adjustment, it improves its positioning to be 5% below the EQA and 3% below the ID.5. However, the Polestar 2 still finishes 4% cheaper than its sibling in this comparison of the single-motor versions.

Volvo’s premium ambitions are revealed in the pricing policy, which might pose an obstacle to customer acceptance and sales success. Also, from an RV-perspective, the high list prices negatively impact %RVs and lead to stronger depreciation.

The Swedish perspective

‘The situation for Volvo in Sweden is a bit different to the other European markets as the premium ambition has to align with maintaining a leading sales position in the domestic market,’ Johan Trus pointed out.

It is therefore even more surprising to see how expensive the Volvo C40 is in comparison to the Polestar. Johan regularly observes and compares leasing offers from independent providers and both, the C40 and XC40, are about 10% more expensive than the Polestar. With this price positioning, it will be interesting to see what sales volume the C40 will be able to claim in the Swedish market.

New-car registrations in Sweden, battery-electric vehicles, April 2021 to March 2022

Between April 2021 and March 2022, the XC40 Recharge stayed 36% behind the Polestar 2 and was the 11th best-selling BEV in Sweden. The main surprise as to registration volumes is the MG ZS EV in fifth place. With the growing share of private leasing and a strong dealership backing the brand, MG managed to achieve this major success and ‘people are willing to give new brands a try, in particular when they do not have to carry any risk’ said Trus.

Residual-value expectations

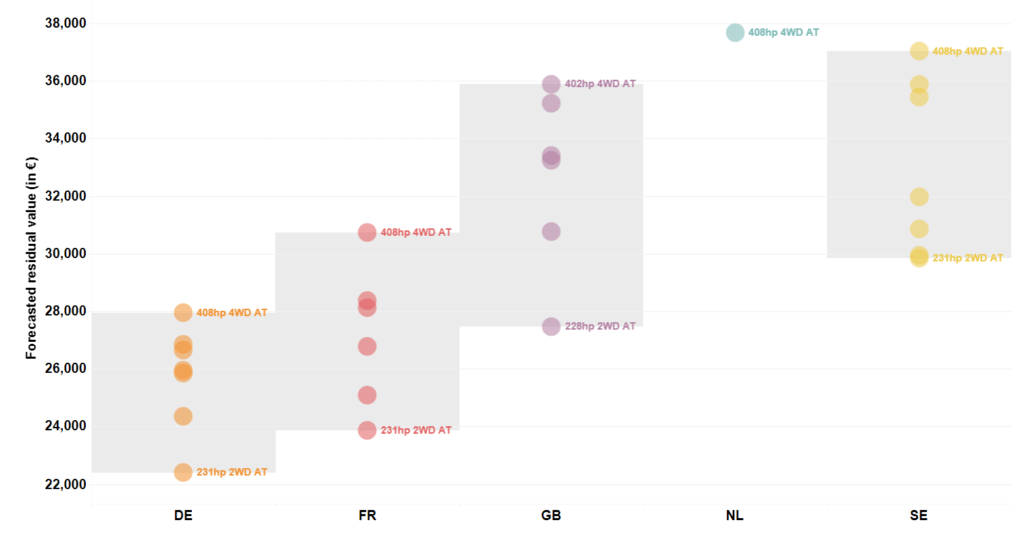

RV forecast values for 36-month-old C40s are lowest in Germany (€22,400-€27,950) and reach values up to €38,110 (SEK 392,310) in Sweden. While the XC40 performs on a comparable level in almost all countries, it has a 10pp advantage in the UK. The Polestar 2 achieves stronger absolute as well as relative RVs in Germany, Sweden and the UK, one reason being the advantageous list-price positioning.

Volvo C40 Recharge RV forecast, 36mth/60kkm, March 2022

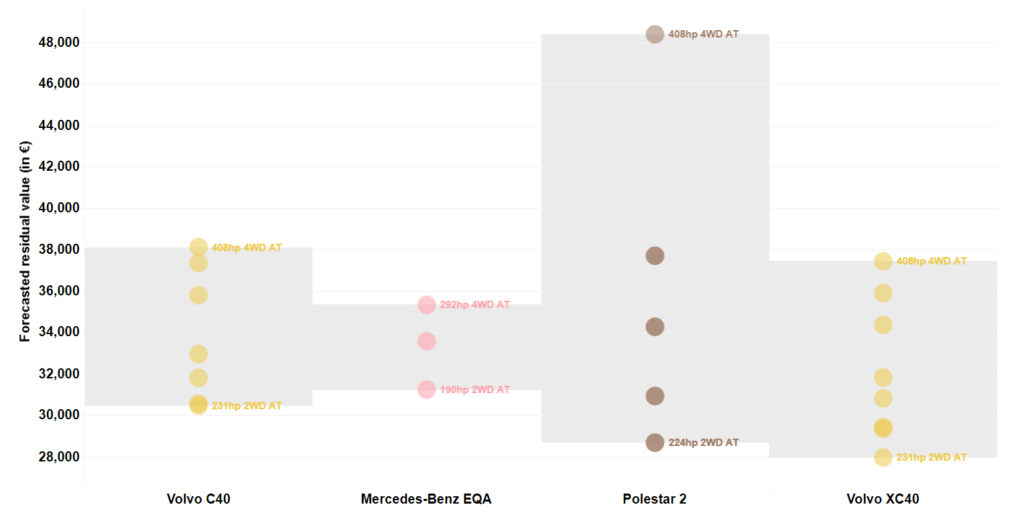

The Mercedes-Benz EQA can leverage its domestic-brand advantage in Germany, achieving the strongest absolute RVs. It also performs strongly in the Netherlands and the UK, while Volvo and Polestar dominate the basket in France and on the home turf in Sweden.

Volvo C40 Recharge RV forecast versus competitors, Sweden, 36mth/60kkm, April 2022

The interactive launch intelligence dashboard provides a cross-country overview of the RV ranges in Germany, France, the Netherlands, Sweden, and the UK. A basket comparison benchmarks the Volvo C40 Recharge against the XC40 Recharge, the Polestar 2, and the Mercedes-Benz EQA.

A beautiful beast

Travelling with an electric vehicle requires more planning and without a doubt you will constantly think about the state of charge, the available infrastructure and if the plug-in point will be able to communicate with one of the many apps on your phone and your car.

My experience during an extended test drive was that once I found a suitable fast-charger, the C40 can charge at up to 150kW and the process worked smoothly. The range prediction of the Google navigation system in the C40 was spot-on and concerns around range and charge points faded.

The Volvo C40 Recharge lets drivers enjoy the brutal acceleration and fun driving experience of a powerful electric vehicle, and is also a good partner for less energy-consuming everyday driving. It is a beauty to look at and a beast for those who want one, but it can easily be tamed.

Close

Close