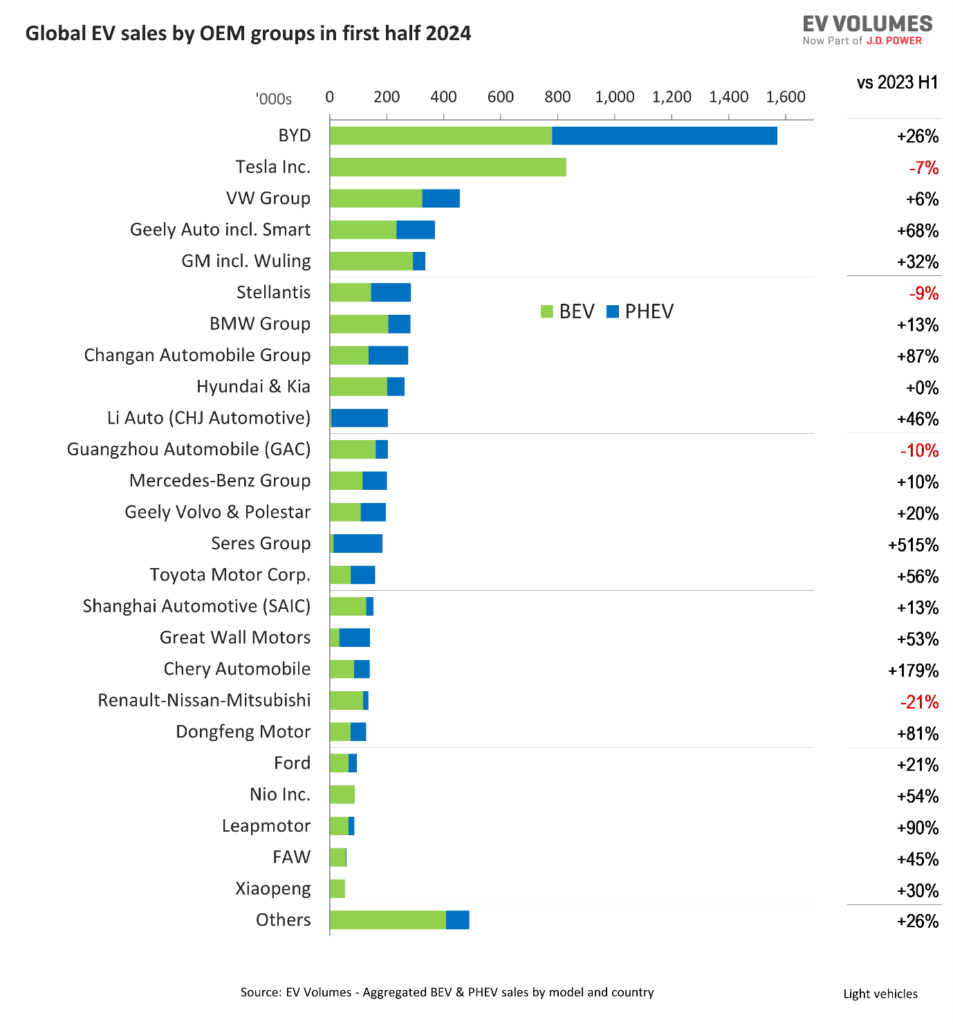

Which electric vehicle (EV) manufacturers stood out in the first half of 2024? EV Volumes founder, Roland Irle, reviews the most successful OEMs in the electric light-vehicle market with Autovista24 editor Tom Geggus.

Covering both passenger cars and light-commercial vehicles (LCVs), the global light-vehicle market saw mixed performances from EV manufacturers in the first half of 2024. One of the most noticeable trends was that OEM success followed regional growth patterns.

Many Chinese vehicle makers recorded impressive growth between January and June. Compared to the restrained results of most Western OEMs, the likes of Geely, Changan, Li Auto, Seres (Aito) and Chery did particularly well.

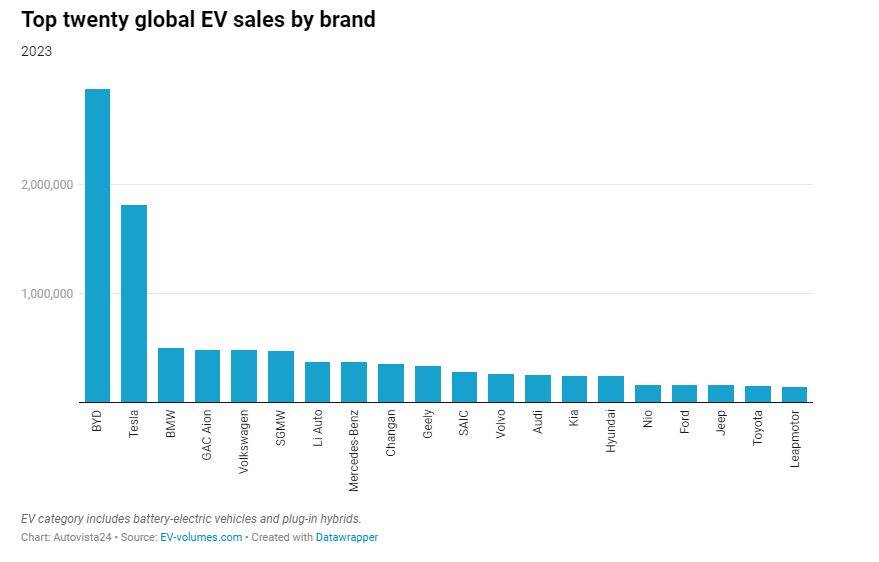

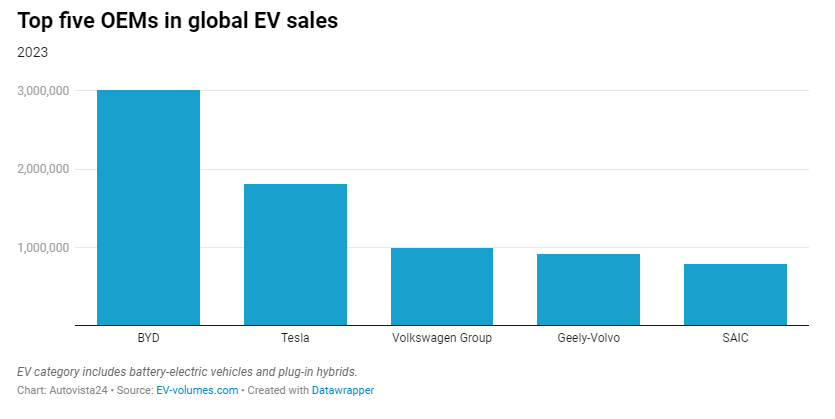

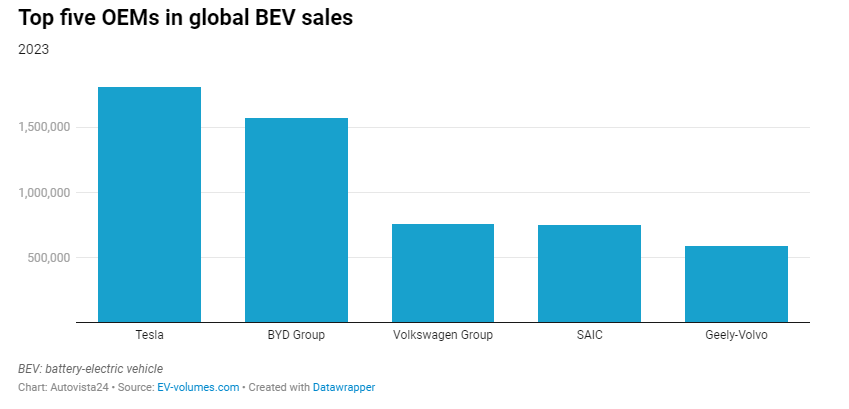

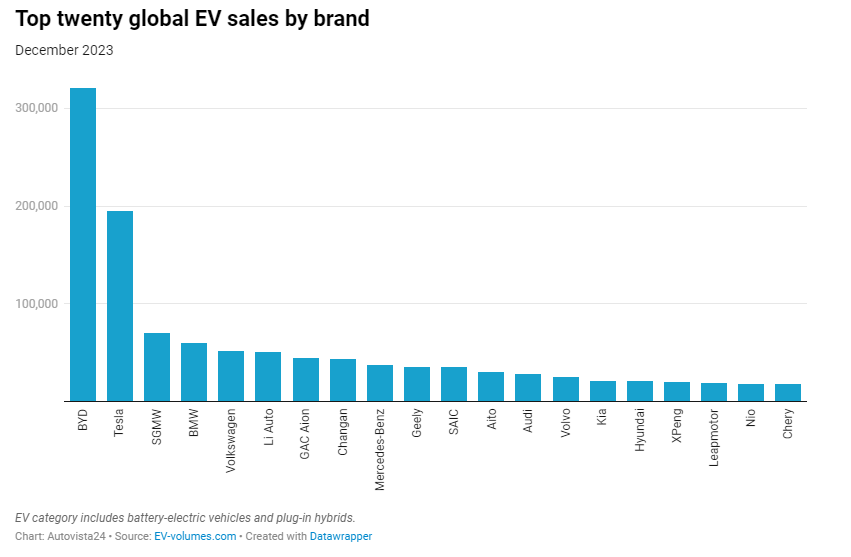

BYD’s year-on-year volume growth slowed to 26%, compared to the 62% surge it recorded last year. Despite this, the manufacturer remained the global EV-market leader.

Its product portfolio featured 37 nameplates for sale in the first half of 2024. This included battery-electric vehicles (BEVs), plug-in hybrids (PHEVs) and extended-range electric vehicles (EREVs). However, BYD is not yet present across all vehicle segments and it does not offer mini-EVs. It is also late to the EREV party.

BYD is also China’s largest OEM by production and sales volumes, despite only offering BEV and PHEV models. It sold roughly 161,000 vehicles outside China, and only some 17,000 in Western and Central Europe. South America, ASEAN, the Middle East and Russia were BYD’s largest export regions, with combined sales of roughly 114,000 units.

Tesla manages to hold on

Tesla was still the leading OEM in terms of global BEV sales between January and June 2024, but only by a small margin. Its deliveries declined by 7% year on year, which is the first time this has happened in this time period. Tesla’s volumes in China, Western Europe, North America, as well as Australia and New Zealand all declined compared to the first half of 2023.

The BEV builder is facing fierce pricing competition in China, while its refreshed Model 3 suffers rollout delays. The base model of the electric sedan was also not eligible for grants under the US Inflation Reduction Act (IRA) as its batteries were built in China. Going forward, the batteries for this variant will be US-sourced.

Monthly volume levels of Tesla models are often erratic, indicating changes in logistics and re-routing of supply, in order to retain grants and avoid tariffs.

Likewise, Volkswagen (VW) Group felt its grip on the global EV market slacken between January and June. It was only able to record 6% year-on-year sales growth, while the global EV market was up 22%.

Audi and Cupra were responsible for the OEM’s growth, while its other brands recorded declines. However, the opposite was true in China, where the VW brand continues to participate in the ongoing price war but Audi and Porsche do not. The Cupra brand is not sold in China.

Geely’s EV gains

Geely was a big winner in the first half of this year, tripling its global EV sector share. Its Chinese brands saw sales increase by 68% year on year.

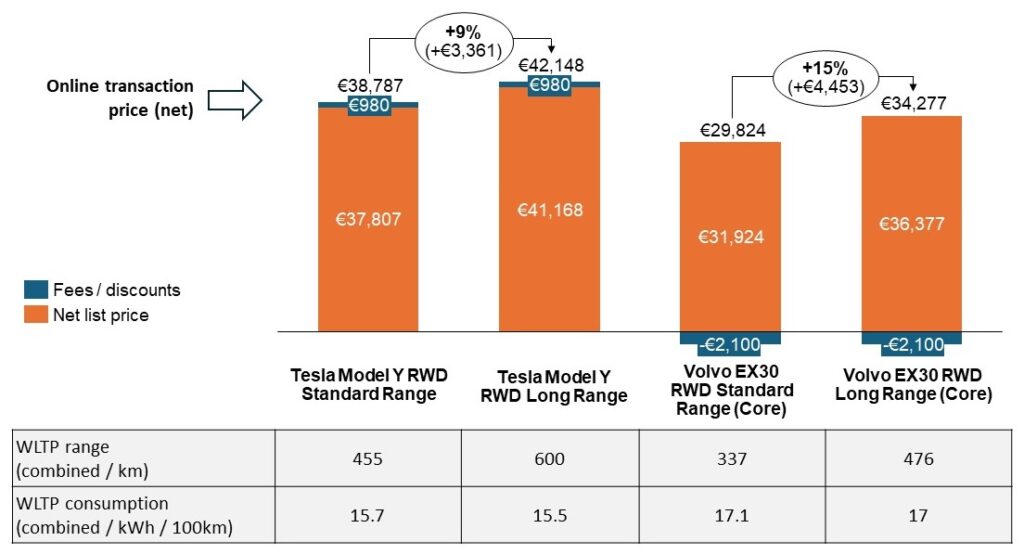

Its European affiliate Volvo has also grown faster than the stagnating European EV market, where the Swedish brand sells most of its EVs. The new Volvo EX30 BEV was an instant hit with some 45,000 units sold in the first half. Approximately 39,000 of them were sold in Europe alone.

Geely, including Volvo, Polestar and Smart (formerly owned by Mercedes-Benz) exported roughly 118,000 units from China in the first half of 2024. Some 98,000 of these units were sold in Europe.

Of these European sales, roughly 93,000 were China-made models from Volvo, Polestar, Smart and Lotus. Import tariffs on China’s EV exports to Europe will limit this potential for growth. This is unless they are exempted from tariff increases or production is relocated to the region.

Jumping 32% in the first half of 2024, GM’s sales grew more quickly than at the same point last year. Several of its new models on the new Ultium battery platform are gaining traction in the US.

In China, the Buick Velite 6 BEV (not built on the Ultium platform) recorded roughly 33,000 sales. This is a new record for Buick in the region, beating all other previous model performances. However, the overall result for GM was dragged down by the phase-out of the Chevy Bolt, including the EUV derivative.

Most of the manufacturer’s recent growth can be attributed to its Chinese affiliate, Wuling. Co-owned by SAIC, the brand has been expanding and upgrading its portfolio. Dwindling sales of the Honguang Mini-EV were offset by the larger Wuling Bingo and the Starlight PHEV. This large sedan comes with a starting price as low as ¥89,000 ($12,400).

Stagnating market affect

Stellantis saw its EV deliveries decline by 9% thanks to its high exposure to Europe’s stagnating EV market. Subsidy cuts have affected sales of lower-priced EVs, an important sector for Stellantis. The OEM’s deliveries in Europe fell by 20%, while sales of Jeep, Dodge and Chrysler models in the US and Canada rose by 35%.

BMW Group sold 13% more EVs in the first half of this year. Mini recorded heavy year-on-year losses of 46%, while the BMW brand saw solid gains of 20%, with particular success in Europe. The German marque sold the second-largest number of EVs in Europe in the first half.

In the last two years, Changan has successfully launched three new brands, Avatr, Deepal and Qiyuan, also known as Nevo. The OEM has a total of 12 models positioned from the entry-premium level upwards, including EREV powertrains.

This effort has paid off. Changan’s sales increased by 87% in the first half, exceeding the 60% growth recorded at the same point last year. The company has plans to enter the Europe market.

Flat sales for Hyundai Motor Company

Hyundai Motor Company saw its sales stay flat in the first half. However, Kia was able to make slight gains over Hyundai. Launched in the summer of 2023, the Kia EV9 recorded some 19,000 sales in the first six months of 2024.

Otherwise, model volume changes were small. The only exceptions were the Kia Bongo and Hyundai Porter, which saw the end of generous electric LCV grants in South Korea. This resulted in a loss of some 17,500 sales. Dropping deliveries in Europe and South Korea were balanced by good growth in the US. In China, the OEM sold only around 3,000 units of the Kia EV5.

Li Auto, known for its large range-extender-equipped SUVs, saw continued sales growth in the first half. Following the launch of the L6 and increasing sales in Russia, the manufacturer managed to record 14,400 unit sales.

Ageing model lineup

GAC Aion’s brands lost momentum due to an ageing model lineup. Mercedes-Benz’s growth was hampered by volume losses in China and the phase-out of proprietary Smart models.

Compared to a weak first half of 2023, Seres saw sales grow by 515% between January and June 2024. Aito’s two new large SUVs featuring EREV technology, the M7 and M9, generated most of this growth. Aito seems set to follow in the footsteps of Li Auto.

Toyota, the world’s largest vehicle OEM, sold roughly 161,000 EV units in the first half. However, this only made up approximately 3% of its total sales. However, the vehicle manufacturer did record healthy year-on-year growth.

While SAIC recorded growth, this fell below expectations. It exported 58% of its volume, roughly 89,000 units. Approximately 56,000 of these models were sold in Europe, 3,000 units behind the first half of 2023.

Chery saw its sales increase with new, more premium entries. However, the OEM’s large export ambitions have not materialised, at least not for its EVs.

Incentives impact

The Renault-Nissan Mitsubishi Alliance experienced difficulties in the first half. The OEM group recorded weak EV sales in Japan. This followed a phase-out of the all-electric Renault Zoe before the Renault 5 and Renault 4 models could be handed the baton.

Purchase incentives are now no longer available for the Dacia Spring in France as it is built in China. This resulted in a drop of roughly 12,000 units, or 80% of its sales in the country.

Dongfeng recorded some 127,400 EV sales across its nine brands, resulting in healthy growth in the first half. The state-owned OEM is a leading manufacturer of internal-combustion engine (ICE) cars and trucks, although, its EV branch appears dysfunctional.

Only 4% of Ford’s total global sales in the first half came from EVs. Meanwhile, Nio, Leapmotor and XPeng all recorded healthy growth as well. However, sales volumes were still far from the 400,000-a-year viability threshold.

Leading EV deliveries

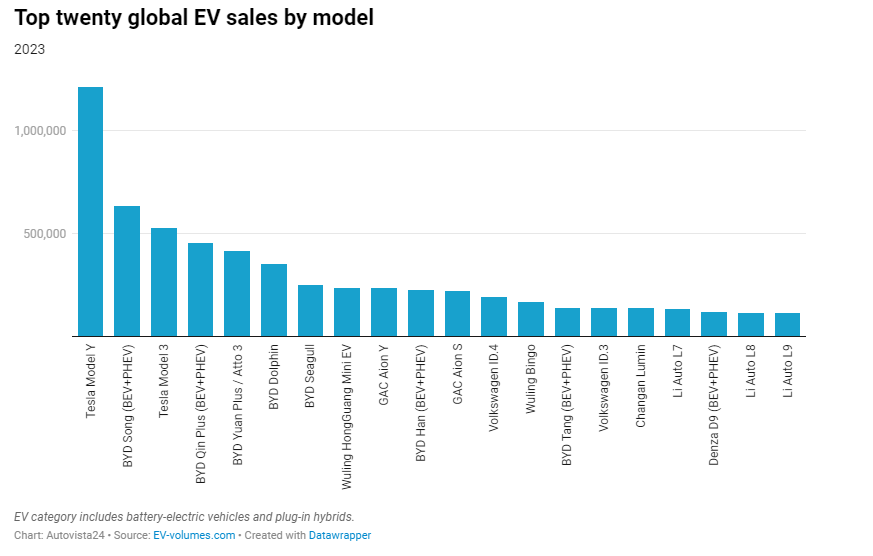

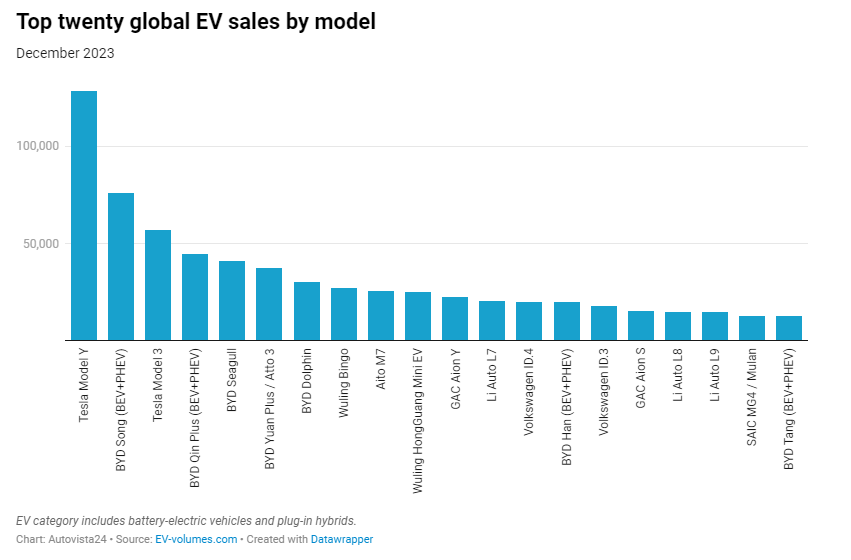

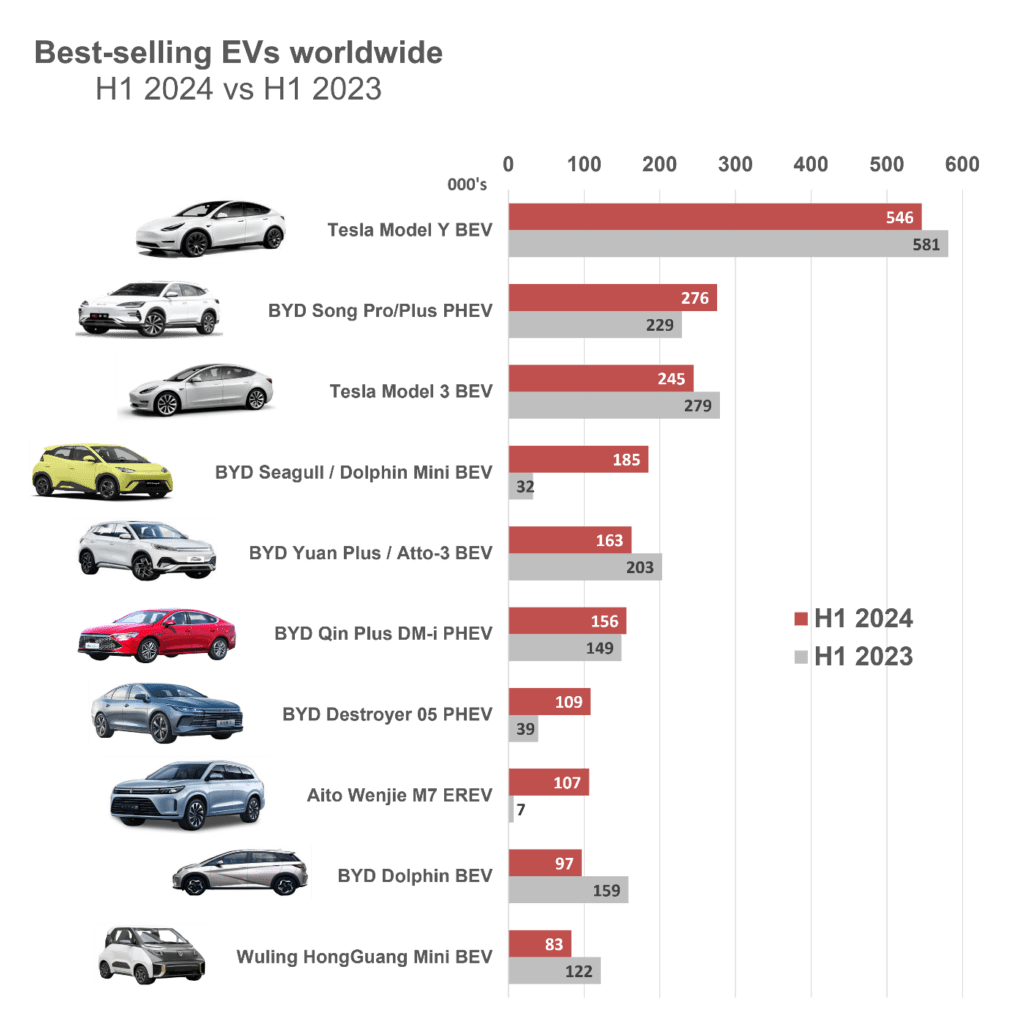

Models from Tesla and BYD led the global EV market in the first half of 2024. The Tesla Model Y was the world’s best-selling vehicle across all categories, including ICE vehicles. However, its figures were down between January and June, particularly in Europe.

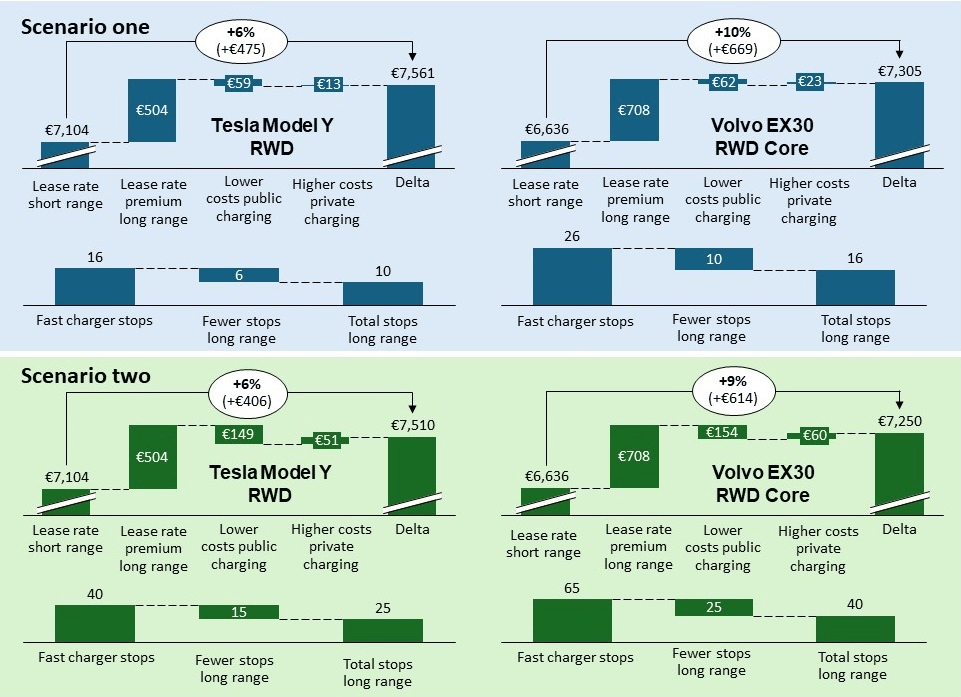

One reason for this was increased competition in the BEV market. This includes the Volvo EX30, the BMW iX1 and iX2, as well as the Hyundai Kona. Even though these models are smaller than the Model Y, they offer an attractive alternative for buyers not concerned about size. If Tesla offered a model in the C-SUV space, this could help the OEM maintain market share.

With the Model Y now five years into its life cycle, a refreshed version, codename Juniper, is around the corner. It will likely produce the same improvements as the Model 3’s refresh. Many will wait to buy a new Model Y or go for a Model 3 in the meantime.

Production of the Model Y in Berlin suffered three unplanned shutdowns in the first half of 2024. This was due to acts of sabotage at the Berlin factory as well as shipping issues in the Red Sea.

The network of high-power fast chargers is improving. Additionally, Tesla grants access to their Superchargers for many other brands now. One of Tesla’s unique strengths is wearing thinner now.

Refreshed results for BYD Song

The BYD Song PHEV was not only the second-best-selling vehicle in China but was also the second-best-selling EV worldwide. The midsized SUV features BYD’s DM-i PHEV technology and starts from ¥136,000. Thanks to its recent refresh, sales increased again in the first half of 2024.

Deliveries of the Tesla Model 3 fell by 12% in the first half. Supply of the enhanced BEV was constrained in the US in the first quarter. Additionally, the base variant did not qualify for IRA grants due to its China-sourced battery.

Sales of the all-electric sedan grew by 41% in Europe but dropped by 22% in China and 36 % in the US. Model 3s sold in Europe are made in China. This indicates that Tesla prioritised European deliveries ahead of the implementation of new import tariffs. To manoeuvre around these new duties, Tesla will need to re-locate volume production for Europe to Berlin.

The BYD Seagull BEV, known as the Dolphin Mini in export markets, is the OEM’s smallest and most affordable model. Starting at ¥70,000, the Seagull undercuts the BYD Dolphin by ¥30,000 and cannibalises sales from its larger sibling.

In fifth, the BYD Yuan Plus BEV, known as the Atto 3 in export markets, saw sales decline by 20%. The Yuan Plus continues to lead the compact SUV segment in China. The model could take this title for the third year running, but it does now face fresh competition. The entire segment is also stagnating as buyers upgrade to larger SUVs which offer more innovations and EREV variants.

BYD’s warship lineup

The BYD Qin Plus DM-I was one of the best-selling models in China, leading the midsize-sedan segment in the first half. It was joined by its sibling from BYD’s warship line-up, the Destroyer 05 PHEV. Both models share the same architecture, powertrain and batteries.

The Qin Plus starts at ¥110,000 in China, while the Destroyer is available from ¥120,000. The model’s main export market is Russia, having delivered 2,500 units in the country in the first half.

Designed in cooperation with Huawei, the Aito Wenjie M7 is a large SUV from the Seres Group. Aito’s model lineup is similar to Li Auto’s, with a focus on large SUVs powered by EREV technology.

The BYD Dolphin finished eighth in the first half of 2024, losing sales to its Seagull sibling. Approximately 30% of Dolphin production is exported, mostly to South America and ASEAN countries. Sales in Europe reached 4,100 units between January and June this year.

The Hongguang Mini EV continues declining from its peak of over 420,000 sales in 2021 and 2022. New competition from the likes of the Changan Lumin and the Geely Panda took its toll. Buyers are also upgrading from mini cars to small cars, such as the BYD Seagull and the Wuling Bingo.

But which models and manufacturers will take home the EV-sales crown at the end of 2024? Keep up to date with the latest data-driven insights from EV Volumes on Autovista24. In the meantime, find out whether the global EV market really did slow down in the first half of 2024.

This content is brought to you by Autovista24.

Close

Close